6 analysts have expressed a variety of opinions on Portillos PTLO over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

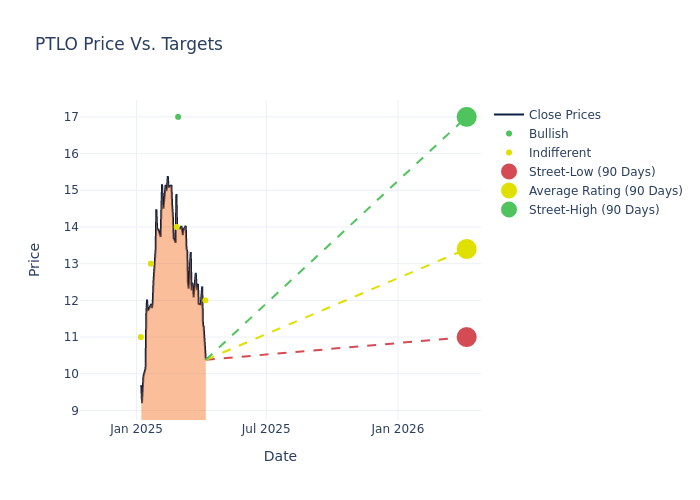

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $14.17, with a high estimate of $17.00 and a low estimate of $12.00. Staying constant with the previous average price target, the current average remains unchanged.

A clear picture of Portillos's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |David Tarantino |Baird |Lowers |Neutral | $12.00|$15.00 | |Chris O'Cull |Stifel |Raises |Buy | $17.00|$16.00 | |Jim Salera |Stephens & Co. |Raises |Equal-Weight | $14.00|$13.00 | |Jim Salera |Stephens & Co. |Maintains |Equal-Weight | $13.00|$13.00 | |Chris O'Cull |Stifel |Raises |Buy | $16.00|$13.00 | |Brian Harbour |Morgan Stanley |Lowers |Equal-Weight | $13.00|$15.00 |

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Portillos's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Portillos analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Portillos Inc serves the Chicago street food industry through high-energy and multichannel restaurants designed to ignite the senses and create memorable dining experiences. It owns and operates fast-casual restaurants in the United States, along with two food production commissaries in Illinois. Its menu includes hot dogs, beef and sausage sandwiches, sandwiches and ribs, salads, burgers, chicken, Barnelli's pasta, sides and soup, and desserts and shakes.

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Portillos faced challenges, resulting in a decline of approximately -1.73% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Portillos's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.1%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.88%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Portillos's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.76%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 1.49, Portillos adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Copyright © 2019-2024 SecurenetWatch All rights reserved. About Us | Contact Us | Disclaimer | Terms Of Use | Privacy Policy